Bank Of Baroda Saving Account Interest Rate

The bank of Baroda is one of the most reliable and trusted banks to provide FD in the market. They are offering a good number of benefits to the investors like that of higher returns, flexible tenure, lower minimum deposit limit, and even provide loans against FD facility among others. Above all, the FD interest rates are the highest being offered on the bank of Baroda FD which is 5.25%. The latest FD rate being offered by the bank of Baroda for the senior citizens ranges between 3.30% to 5.75%.

Features of Bank of Baroda Fixed Deposit

This is indeed providing with one of the best investment option that is available for the depositors. The one indeed is best for those who are looking for investment in fixed income instrument and is earning higher returns than that of saving account. The key features are like:-

- An expert guide for Bank of Baroda Deposits and Accounts. Check here Deposit Slip, Deposit machine, Plans, Deposit Rates, interest rate calculator, Deposit calculator, type of Deposit Schemes (Fixed Deposit, Term Deposit, Recurring Deposit ).Know rules associated with Savings, Current and Salary Accounts.

- INTEREST RATES APPLICABLE w.e.f. Type of Deposit Account. Nominal Interest Rate. Actual Interest Rate (Effective) p.a. Minimum Balance required.

Interest Rates on Deposit (AED) w.e.f.Terms: Rates are subject to change from time to time and Negotiable. Rate of interest on various deposits (including NRI Deposits) and advances in India please click here. For Deposit other currency and less than AED 25000 please contact to branch. Baroda Savings Account. Docs required for opening Savings Bank Account: (A)Common Documents (B) Nationality: KENYAN. You can earn an interest in the range of 3.5-6% on your savings accounts, depending on the amount and the bank.Kotak Mahindra Bank has lowered rate of interest on savings account deposits of up to.

- The amount can be opened with less amount of around Rs 10,000 and more.

- The tenure of the FD ranges between 7 days to 10 years.

- The interest rates ranges between 2.80 % per annum to 5.25% per annum.

- The senior citizens can have fixed deposit with rate of 3.30 % to 5.75% per annum.

- As per financial information, the bank of Baroda is offering with highest interest rates on FD which is 5.25% offered for time period of 10 years.

- The bank of Baroda safety deposits are covered under the deposit insurance scheme of RBI in which up to rs 5 lakh of all deposits of the depositors are insured by DICGC.

- It is also providing with loan against FD to help the depositors meet their liquidity requirements without breaking the FD.

- The bank is also providing with auto renewal as well as nomination facility.

- Bank of Baroda has launched some of the special schemes and popular FD schemes like short deposits, bank of Baroda double dhamaka deposit schemes, advantage fixed deposits non callable schemes, fast access deposits, BOB suvidha fixed deposit schemes, regular income plan, monthly income plan, bank of Baroda tax savings, term deposits, money multiplier deposit.

The bank of Baroda is offering with higher rate of interest as compared to their saving deposits. So the benefits of opening a FD Account in bank of Baroda are like:-

- The interest on deposit is being paid only at the time of maturity.

- Providing with best of option for nomination facility.

- Extra interest rate of 0.25% to 0.50 % is payable to the senior citizens.

- There is availability of auto renewal facility on deposits.

- The customers can earn higher returns on the deposited money.

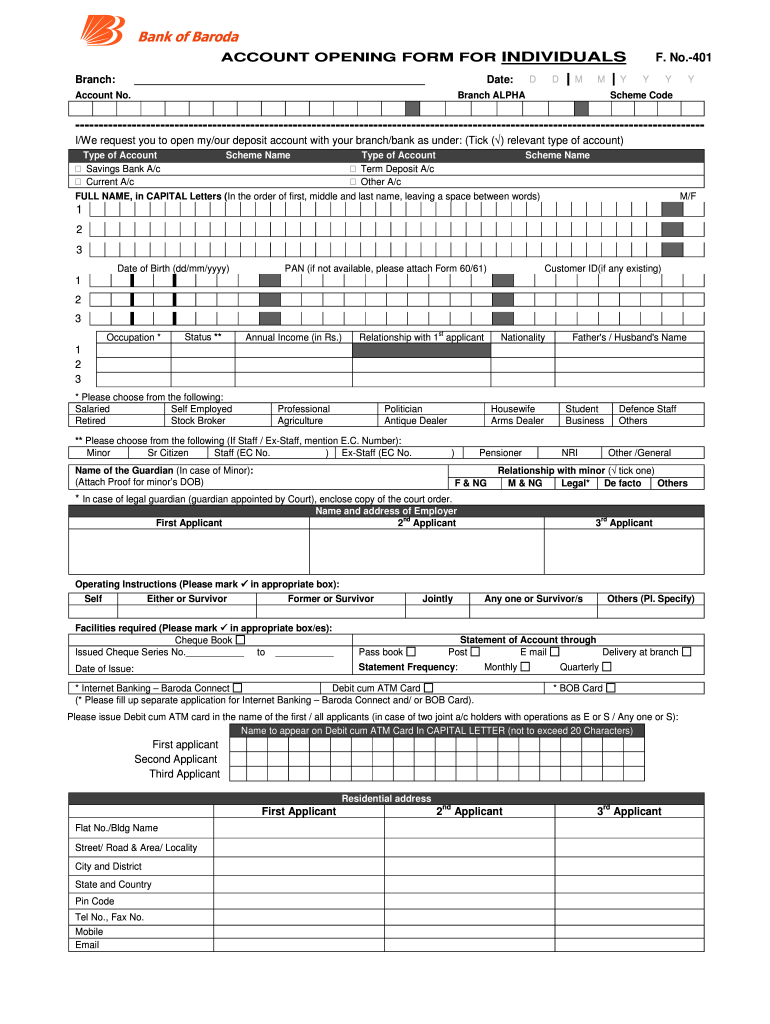

For this one need to open a fixed deposit account in the bank. There will be need of identity proof, residence proof like that of aadhar card, PAN card or driving license. Even a pass port size photographs are required as a part of identification in the fixed deposit account.

Bank of Baroda Fixed Deposit Rates

The bank is providing here by the deposit rate chart for better understanding by the customers:-

Gayatri Mohapatra

Gayatri Mohapatra has 10 years of experience in content writing. She write on all niches specially with banking (worked as a professional Banker for 4 years). She is keen learner for which she choose this profession.

A Savings Account is very beneficial with multiple advantages as detailed below:

(1) Earns Interest on your Savings

This is the first and foremost benefit of opening a savings account. It starts earning interest on your money as soon as it is deposited. The interest rate is decided solely by the bank and changes from time to time. Regular interest depends upon the balance of the savings account.

Interest rate in savings account ranges from 3.5% to 7%.

(2) Provides Security of Funds

There is no risk involved in your savings account. It is considered as one of the safest investment alternatives. It even offers you the opportunity to put your money into another investment whenever the time comes.

(3) No Lock-in Period

There is no lock-in period under savings account which means that you can withdraw your deposits anytime you need. There is no need to keep your money in this account for any specific period. You have full flexibility in withdrawal of amount from it.

(4) Offers Liquidity

You can withdraw the amount anytime 24X7 with the use of ATM card or debit card from your account during any emergency even when the bank is closed. In fact, being able to access your money when you need it, is one of the biggest benefit of having a savings account.

(5) Availability of Variety of Savings Account

Many banks offer comprehensive range of savings accounts from regular to premium suiting to your personal banking needs. There are different types of savings accounts offered by various banks that differ based on the interest rates and duration of time commitments. You can choose any of them which suits your financial objectives and requirements.

(6) Services of Customer Relation Manager

Now-a-days many of the banks engage a Customer Relation Manager (CRM) who will help not only solve your queries but also assist you in tax saving, investment, mutual fund schemes, insurance, bank procedures, etc. You need to just call your CRM and he/ she will assist you solve your problem.

(7) Online Banking Facilities

If you maintain a savings account, you can make many transactions online also such as payment of bills, fund transfers using RTGS/ NEFT or IMPS, etc. This will save your time and efforts.

(8) Provides ATM/ Debit Card

You will be offered a debit or ATM card with a nominal charge or without any charges, as offered by your bank. With the help of this card, you can withdraw the funds, make transactions in shops, make payments of bills, etc.

(9) Helps you Get Credit or Loan

The relation you maintain with the bank will help you in getting credits from the bank such as home loan, personal loan. You will also be in a position to negotiate with the banker on the interest rates.

(10) No Cap on Deposits

There is no limit on the amount deposited and number of times it is deposited.

(11) Facility to link Loan EMIs, Mutual Fund SIPs or RD deductions

7% Interest Rate Savings Account

You get a facility to link your monthly loan EMIs, Mutual Fund SIPs or RD deductions through the savings bank account.

(12) Free Mobile App

2% Interest Rate Savings Accounts

Most of the banks provide their mobile app for free. Through this app, you can get to know your account balance, check your statement, make transactions, easy transfer of money, etc.